Ecotierra closes USD 10.8 million investment in RSCF-supported Kuska agroforestry project in Peru

The Restoration Seed Capital Facility is proud to announce that Ecotierra’s Urapi Sustainable Land Use Fund has successfully closed an investment of USD 10.8 million in Peru, with the Facility’s support. RSCF provided project development support in the form of reimbursable grants, notably to enable Ecotierra...

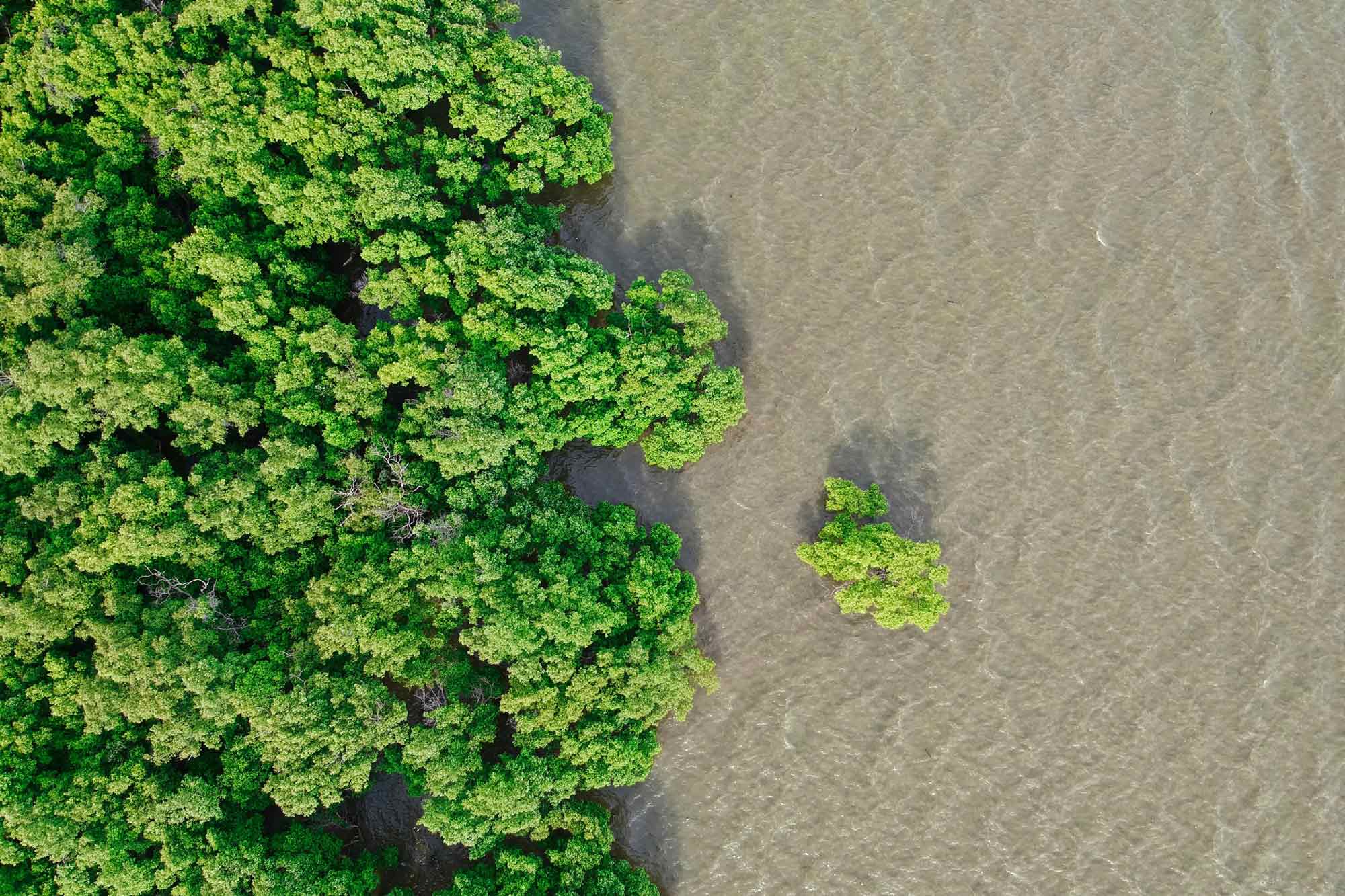

New Forests investment in Thailand

RSCF partner New Forests has announced the first investment for its Tropical Asia Forest Fund 2 (TAFF2). This project, which has benefitted from the Facility’s support in its development, will contribute to conserving and restoring the Kuan Kreng Landscape (KKL) in Thailand....

Successful investment of ECOTIERRA’s Sustainable Land Use Fund in Honduras

The Restoration Seed Capital Facility is proud to announce that ECOTIERRA’s Urapi Sustainable Land Use Fund has successfully closed an investment of USD 9.2 million in Honduras, with the Facility’s support.RSCF provided project development support in the form of reimbursable grants, notably to enable Ecotierra to achieve...

Impact Earth announces second closing of the Amazon Biodiversity Fund

The Amazon Biodiversity Fund (ABF), a Brazilian impact fund advised by Impact Earth, aims to mobilize venture and early growth capital for sustainable enterprises with a transformational positive impact on biodiversity and local communities in the Legal Amazon of Brazil. With two new investors on board,...

Unlocking Private Finance for Forests and Sustainable Land Use: Sharing Lessons and Opportunities to Scale up Investment in the LATAM Region

Investment in nature-based solutions must double by 2025 and triple by 2030 to meet global climate and biodiversity targets according to the United Nations Environment Programme’s State of Finance for Nature Report. Accounting for only 17% of current investment in nature-based solutions, private finance must rapidly...

Campo Capital and Impact Earth Approved by the Restoration Seed Capital Facility to Accelerate Private Investments in Landscape Restoration

The Restoration Seed Capital Facility (RSCF) has approved Colombia-based, Campo Capital as the first partner to qualify for new fund development support under the Facility’s Support Line 1. In addition, RSCF has approved Impact Earth as a new partner to receive support to identify and...

New Forests is driving restoration investment markets in Southeast Asia

New Forests is a global investment manager of nature-based real assets and natural capital strategies, with a diversified portfolio of approximately USD 7 billion in nature-based assets including sustainable timber plantations and conservation areas, carbon and conservation finance projects, agriculture, timber processing and infrastructure investments. New...

Sharing Lessons Learnt from the Restoration Seed Capital Facility with Arbaro Advisors and Ecotierra

On 8 June 2023, RSCF held a knowledge exchange webinar where RSCF partners Arbaro Advisors and ECOTIERRA shared valuable lessons learnt on developing strong pipelines of bankable, restoration-focused projects. Hanna Skelly, Managing Director of Arbaro Advisors, highlighted the ongoing need for targeted fund manager support to...

Restoration Seed Capital Facility Annual Report 2022

RSCF has achieved significant environmental and social impacts in its first full year of operations, with four partners onboarded and new interest in the Facility’s support creating a positive outlook for 2023. Read more about RSCF’s supported activities, partners and future priorities in the Facility’s Annual...

Practical Guidance to Develop Environmental & Social Impact Frameworks

To meet global climate, biodiversity and land degradation targets, private investment in sustainable land use must rapidly scale up, according to the United Nations Environment Programme’s State of Finance for Nature report. Fortunately, there is a gradual but persistent move by banks, investors and corporations to go...