New Forests is a global investment manager of nature-based real assets and natural capital strategies, with a diversified portfolio of approximately USD 7 billion in nature-based assets including sustainable timber plantations and conservation areas, carbon and conservation finance projects, agriculture, timber processing and infrastructure investments.

New Forests is fostering a growing interest in restoration-focused investments in Southeast Asia to mobilize increased private capital to the sustainable land-use sector. The Restoration Seed Capital Facility (RSCF) is supporting New Forests to expand the pipeline for its second Tropical Asia Forest Fund (TAFF2) and further enhance the positive environmental and social (E&S) impacts of its investments.

TAFF2 is the first of New Forests’ funds to have a blended finance structure to drive additional impact outcomes. TAFF2 reached its first close of USD 120 in early 2022, attracting the interest of major public and private sector investors such as the Asian Development Bank (ADB), the Australian Government, the David and Lucile Packard Foundation, Sumitomo Mitsui Trust Bank (SuMi TRUST), Temasek and TotalEnergies.

For Carrie Heng, Associate Director at New Forests, “It was really refreshing to see major public and private sector institutions start to invest into TAFF2. We have seen a greater amount of interest from investors in Asia in the last two to three years due to the growing corporate focus on sustainability and setting net zero targets. We anticipate these anchor investors will now catalyze increased private sector investments in sustainable land use across Asia.”

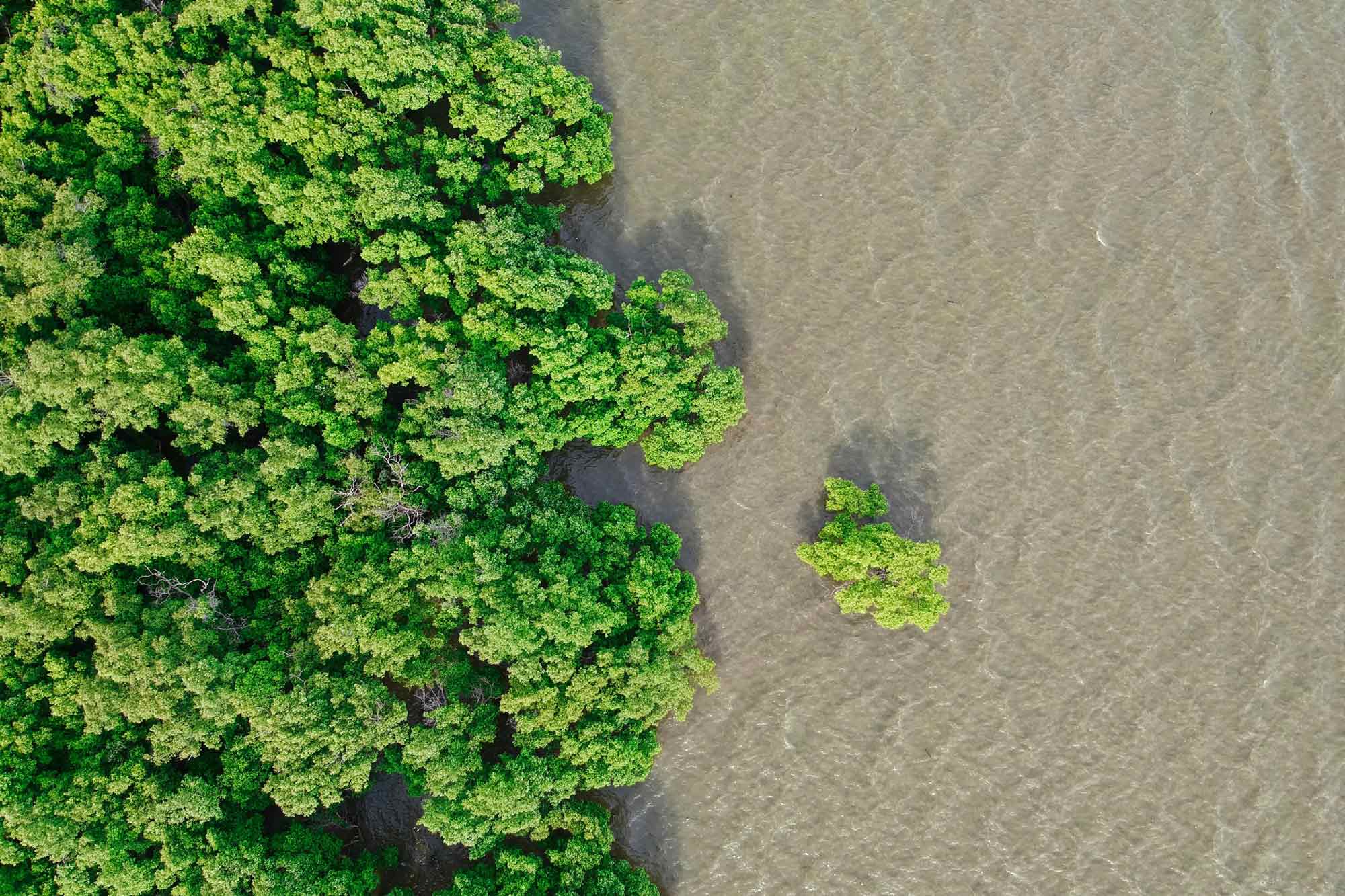

New Forests is currently in the process of identifying opportunities to deploy TAFF2 in Malaysia, Indonesia, Vietnam, Thailand, Laos and Cambodia. “The strategy of TAFF2 is focused on sustainable plantation forestry and processing asset investments as part of a mixed landscape approach. In addition, we have a mandate to invest into conservation and restoration assets for the purpose of generating carbon credits through the voluntary carbon market.”

This dual investment mandate is central to TAFF2’s impact strategy. “As a company we advocate for shared value for the communities in which we operate. We have an investment mandate to generate a commercial return, but it’s not at the expense of the communities or the countries where we operate. Our investments aim to deliver strong financial returns and positive impacts for livelihoods, biodiversity and climate at the same time,” said Heng.

Achieving positive E&S impacts together with strong financial returns

Structured as a blended finance vehicle, TAFF2 raises capital in two pools, one from commercially driven investors and one from more impact-focused investors, who accept a lower return in exchange for the delivery of positive livelihoods, biodiversity and climate impacts. “With this fund structure, we aim to deliver strong financial returns and the positive E&S impact outcomes that our investors value through a dedicated impact tranche,” said Heng.

While TAFF2’s unique blended finance structure finances the impact tranche’s E&S activities, Heng sees an opportunity for voluntary carbon markets to enable the impact tranche to independently generate financial returns through the sale of carbon credits. “Conservation and restoration projects are now more financially viable as opposed to 12 years ago when we raised our first fund, where such a market didn’t really exist,” explained Heng. “As the market develops, we’re able to make these projects a lot more financially sustainable, which also means that when we exit the fund, it’s easier to sell the assets on to the next pool of investors who are able to continue to develop the projects and realize longer term E&S impacts.”

New Forests has developed a demand-side integrity policy that ensures that the carbon credits they generate are exclusively sold to buyers that are actively reducing their emissions to achieve a net zero target. In addition, each of New Forests’ carbon projects have a climate, community and biodiversity (CCB) standards certification to ensure that the project achieves climate, community and biodiversity benefits while generating carbon credits.

While the voluntary carbon market remains a core revenue focus, New Forests sees biodiversity credits as an emerging opportunity to demonstrate the value to its restoration and conservation investment projects. “While still a nascent sector, we are seeing that investors are willing to pay a premium if you’re able to demonstrate investments are not only focusing on carbon, but there is also positive biodiversity and livelihoods impacts as well,” explained Heng.

Accelerating pipeline development

RSCF’s pipeline and project development co-financing is supporting New Forests throughout the early stages of TAFF2’s investment screening and risk assessment processes. By providing additional resources in the form of reimbursable grants, RSCF enables New Forests to evaluate the regulatory and technical viability of more investment projects. RSCF’s support is helping to expedite the due diligence process, maximize E&S additionality and provide more in-depth investment proposals to the investment committee (IC).

Providing an additional level of detail to an IC, particularly regarding E&S evaluations and impact assessments, is critical to accelerating restoration investment pipeline processes. According to Heng, “RSCF allows us to go and do a bit more digging and expand the number of projects we can screen. RSCF enables New Forests and TAFF2 to screen and assess more pipeline projects before the Investment Committee considers the projects that have been through the rigorous due diligence process.”

In addition, RSCF support provides a degree of risk cover to assist fund managers throughout the resource intensive due diligence process. “For carbon projects, where there is often a three-year process between project inception and the issuance of credits, risks are inherent,” explained Heng, “RSCF’s support provides a safety net in case of unforeseen challenges. This partial risk cover ensures investors’ capital remains secure throughout the due diligence process and can be redirected to other projects if needed.”

Learn more about TAFF2 here.