The Restoration Seed Capital Facility (RSCF) has approved Colombia-based, Campo Capital as the first partner to qualify for new fund development support under the Facility’s Support Line 1. In addition, RSCF has approved Impact Earth as a new partner to receive support to identify and develop a strong pipeline of restoration-focused investments in the Amazon.

RSCF will provide Campo Capital with a reimbursable-grant to accelerate its efforts in establishing a new restoration-focused fund, which will expand Campo Capital’s operations in Latin America and contribute to the sustainable management, protection and restoration of forest ecosystems. The objective of RSCF Support Line 1 is to support first time fund managers through the fund establishment and fundraising stage until the fund reaches its first close.

RSCF will support Impact Earth to expand the pipeline of the Amazon Biodiversity Fund (ABF) with a combination of reimbursable and non-reimbursable pipeline and project development grants under the Facility’s Support Lines 2 and 3.

“Providing reimbursable grant support for fund managers stimulates more private fund managers and investment advisors to set up new funds that focus on forest and landscape restoration,” said Ivo Mulder, Head of the UN Environment Programme’s Climate Finance Unit. “Investment in nature-based solutions must double by 2025 and triple by 2030 to meet global climate change, biodiversity and land restoration targets according to UNEP’s 2022 State of Finance for Nature Report. Supporting new restoration-focused funds to develop and reach first finance close is critical for unlocking private finance for landscape restoration.”

About Campo Capital

Campo Capital is first time impact fund manager, with extensive experience in structuring, developing and managing projects in the agricultural, forestry, alternative energy and rural development sectors. The agricultural and foresty projects currently under Campo Capital’s management have achieved the highest environmental production standards. The development of a new fund will allow Campo Capital to scale up its operations across agroforesty and forest conservation activities.

RSCF will support Campo Capital to develop the new 10-year Campo Capital Impact Fund, which has an investment target of USD 70 million to deploy to agroforestry and ecosystem conservation projects in Latin America across a 5-year investment period.

The Campo Capital Impact Fund aims to sequester more than 10 million tons of CO2 equivalent through its investments in native forestry species plantations that are expected to produce 1.5M tons of timber and more 150K tons of sustainable agricultural products. The fund intends to protect and conserve the diverse ecosystems in which it operates as well as providing employment opportunities for local communities.

“At Campo Capital we are passionate about nature and we are convinced that nature-led investments can generate commercial returns as well as environmental and social impacts. In RSCF we have found a partner with a shared vision, who believes that our projects can drive positive impacts and who can support us to achieve our goal of creating Campo Capital Impact Fund,” said Diego Lozano, Founder of Campo Capital.

About Impact Earth

Impact Earth is an impact fund manager dedicated to co-building the impact economy in the Amazon by investing in the future leaders of the market. Impact Earth focuses on catalysts for innovation to drive environmental and social impact at scale.

RSCF will support Impact Earth to develop the investment pipeline of ABF, which has a fund target size of USD 50 million to deploy to biodiversity-positive businesses across the Legal Amazon.

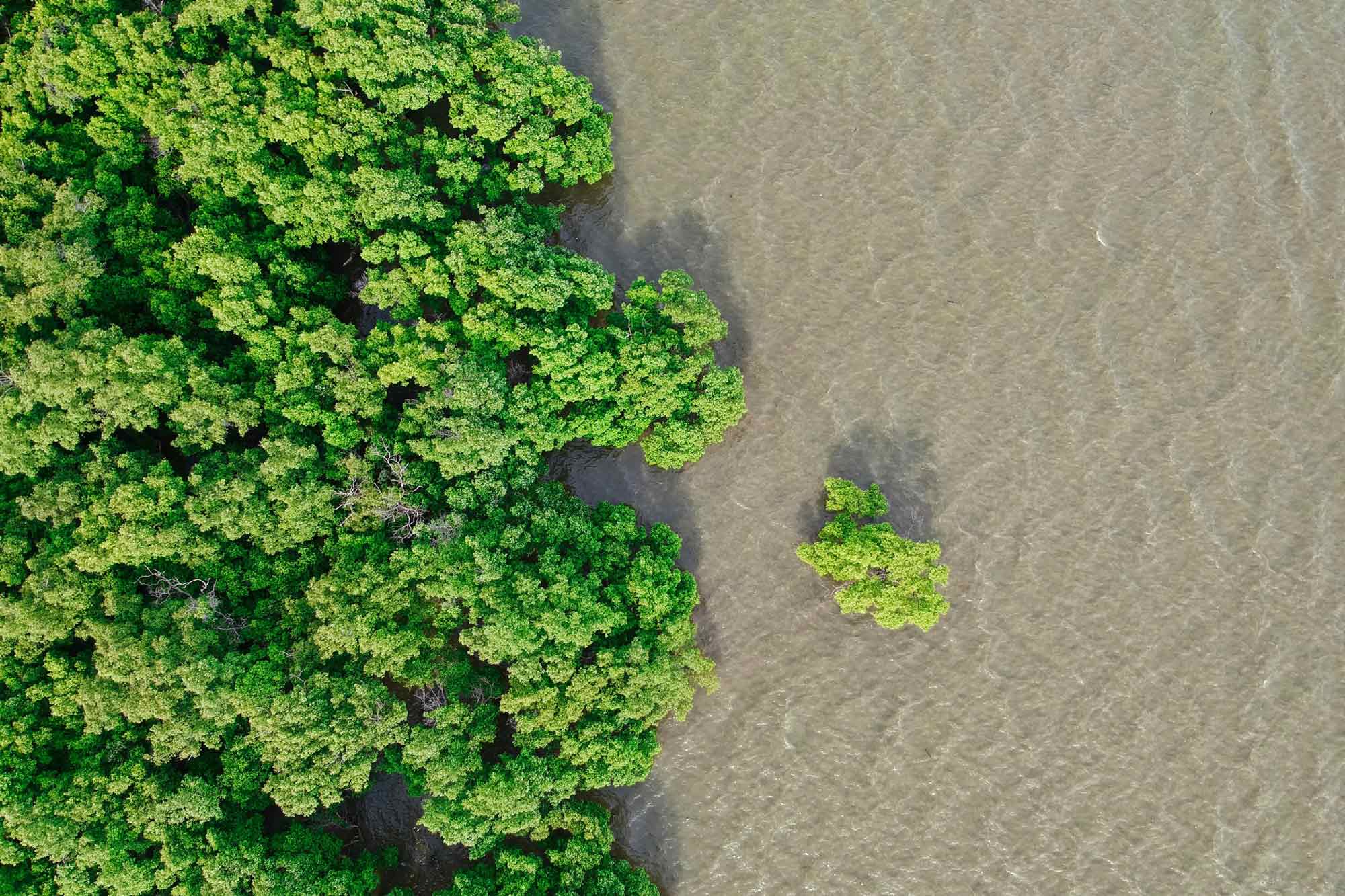

The ABF invests in sustainable enterprises and projects that have a transformational, positive impact in the Legal Amazon of Brazil. Utilizing innovative financing structures, the ABF provides tailor-made financing solutions with de-risking mechanisms from revenue-sharing loans to mezzanine debt and equity. The ABF invests in early stage, yet scalable, projects and companies across four investment pillars: conservation, reforestation and community livelihoods, smallholder value chains, sustainable farming and innovation in technology and access to finance and services.

ABF currently invests in a diverse portfolio of reforestation, agroforestry and smallholder value chain businesses. RSCF’s support will enable Impact Earth to expand the pipeline of ABF’s investments and channel more funding to promising & impactful initiatives that promote new approaches to conserving biodiversity, addressing deforestation and climate risks and creating positive socio-economic and well-being outcomes for local communities in the Legal Amazon.

“ABF is an ambitious fund operating in a frontier market, facing unique challenges and opportunities. The risks and challenges of working in the Brazilian Amazon have precluded most impact investors from expanding into the region. The support from RSCF will be critical to help our team overcome these inherent challenges, drive forward new opportunities and unlock finance for transformational businesses that have a positive impact on the biodiversity and communities of the Brazilian Amazon,” said Nick Oakes, Co-Founder of Impact Earth.

About the Facility

Supported by Germany and Luxembourg and implemented by UNEP and the Frankfurt School of Finance and Management, the Restoration Seed Capital Facility is a unique initiative to promote private investment in forest restoration. Scaling up private finance for forest landscape restoration contributes to the achievement of the Sustainable Development Goals and the three Rio Conventions by: restoring degraded land in line with the UN Decade on Ecosystem Restoration, the Bonn Challenge and UNCCD Land Degradation Neutrality targets; strengthening climate mitigation and adaptation efforts consistent with the Paris Climate agreement; and protecting and restoring biodiversity in accord with the CBD Global Biodiversity Framework.

The Restoration Seed Capital Facility aims to scale up forest and landscape restoration significantly during the UN Decade on Ecosystem Restoration 2021-2030. It was launched in October 2020 and is open to applications from any fund manager or investment adviser developing or running an investment vehicle targeting restoration-aligned activities.

For more information on the Restoration Seed Capital Facility please follow the below links:

Contact

For media enquiries, please contact: laura.phillips@un.org

For RSCF related questions, please contact: info@restorationfacility.org