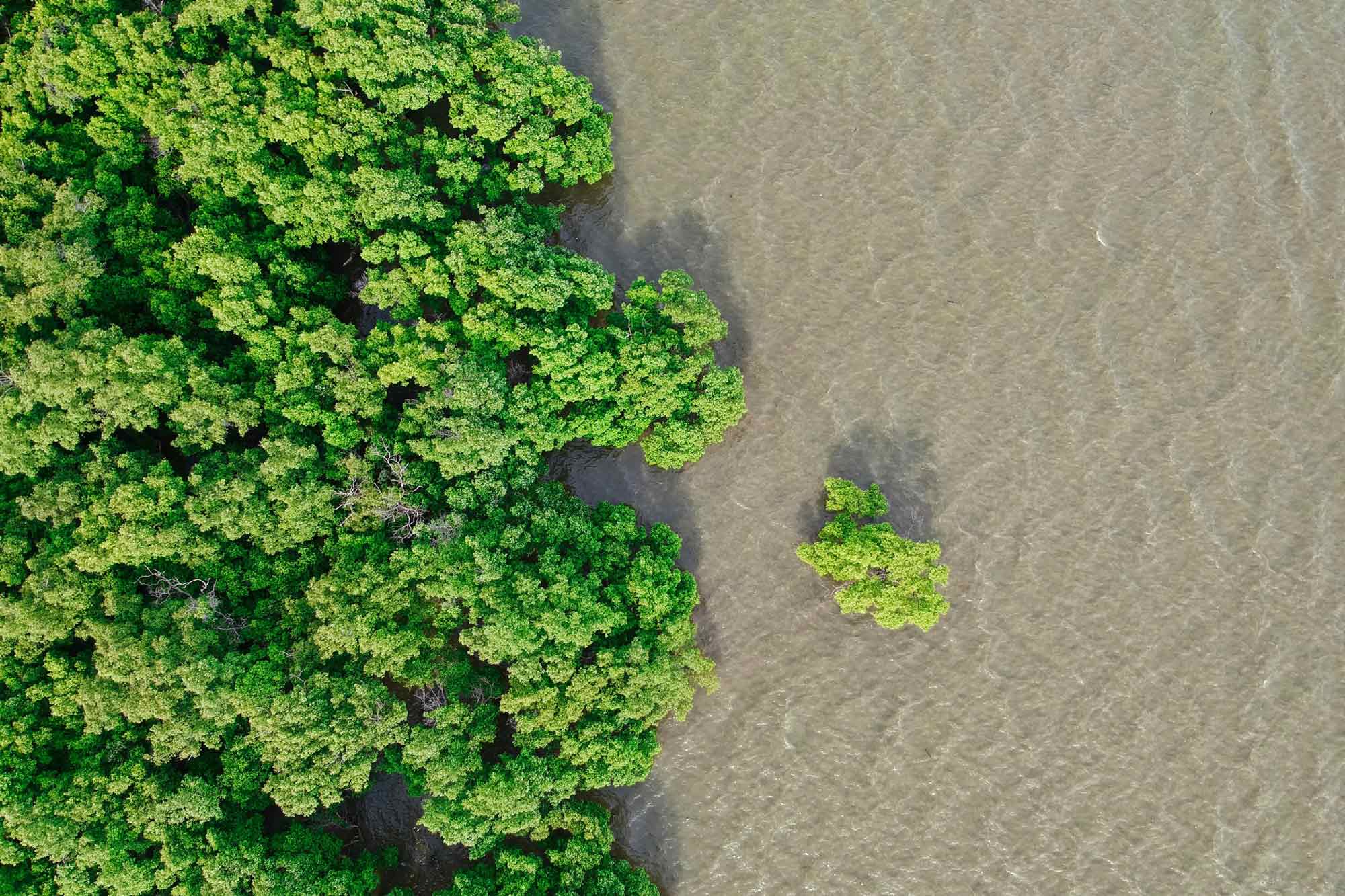

To meet global climate, biodiversity and land degradation targets, private investment in sustainable land use must rapidly scale up, according to the United Nations Environment Programme’s State of Finance for Nature report.

Fortunately, there is a gradual but persistent move by banks, investors and corporations to go beyond risk management and certification standards, to embed positive environmental and social impacts (E&S) across investment portfolios and supply chains.

In this context, UNEP developed the Land Use Finance Impact Hub and the Positive Impact Indicators Directory. These resources provide guidance for fund managers to maximise positive E&S impacts for forest landscape restoration (FLR) investments. Designed to support new and experienced fund managers in the sector, the Indicators Directory provides a roadmap to develop best practice E&S impact frameworks that attract diverse sources of concessional finance and increased flows of private capital.

The Indicators Directory aims to harmonize E&S assessments under five key impact areas: climate, forests, biodiversity, livelihoods and sustainable production with 20 corresponding KPIs, analysis methodologies and tracking systems according to fund manager capacity and resources. Through a menu of E&S impact areas, the Directory can suggest which KPIs funds should apply as the building blocks of a risk and impact management framework.

The Indicators Directory can support banks, investors, fund managers, government agencies and other relevant parties to systematically assess positive E&S impacts generated for investments in the quickly emerging field of forest and landscape restoration by guiding:

- what data to collect

- what measurement systems to use and how to report (MRV)

- the level of resources needed to collect data and conduct analysis

By standardizing E&S impact frameworks, UNEP intends the Indicators Directory to support the emergence of a new ‘’asset class” for nature-based solutions (NbS). Establishing a benchmark for market transparency and traceability, including the E&S impacts generated, provides an important foundation for fund managers and investors to measure, evaluate and compare investments. Expanding access to publicly available resources and information in this sector is critical to support the entrance of new market actors and the acceleration of much-needed private finance and investment in NbS.

The Indicators Directory currently supports the E&S impact framework for UNEP partners such as &Green, the AGRI3 Fund and the Responsible Commodities Facility as well as the partners and signatories of the Restoration Seed Capital Facility, Innovative Finance for the Amazon, Cerrado and Chaco (IFACC) and the Good Food Finance Network (GFFN). Additionally, several external organizations are using the directory to build their own indicators’ list or E&S frameworks. This includes the Global Impact Investors Network – GIIN and its IRIS+ benchmark on agriculture, the Landscape Finance Lab. and others. Finally, the team behind the Indicators Directory is engaged with several public and private initiatives including DFI platforms and government programs to collaborate on alignment of indicators, tools and frameworks. This collaboration effort is saving user time and resources by replicating best practices sourced from industry peers.

Case studies

Learn more about how the AGRI3 Fund and Responsible Commodities Facility have applied the Positive Impact Indicators in the following case studies:

AGRI3 Fund global application of the KPIs

Responsible Commodities Facility adapting KPIs to the Brazil context

Key steps for fund managers and investment advisors to consider when responding to E&S risks in land use finance

- Seek guidance from tools such as the Positive Impact Indicators Directory that can support the identification and assessment of land use-related risks

- Define the fund’s impact objectives and identify key E&S risks that are material for the fund’s potential investments

Common risks include:

- Deforestation, conversion and land degradation

- Biodiversity loss and overlap with protected areas

- Climate change exposure / vulnerability / hazards

- Affecting yields / production and financial returns / performance

- Affecting reputation and license to operate

- Livelihoods (labour, gender, land tenure and IPLCs)

- Water usage

- Compliance with international, national and sub-national laws and regulations

- Develop a fund strategy that focuses on delivering impact objectives including a risk management framework to manage and mitigate risks of potential investments

Common considerations to developing a risk management framework include:

- Establish the basis for risk identification at a portfolio and transaction level, and understand mitigation actions that funds can take to reduce these risks

- Decide on what level of risk is acceptable and balance impact with risk

- Set eligibility criteria including deforestation/conversion cut-off date

- Develop an exclusion list

- Develop a robust due diligence process

- Develop a risk screening process – and what happens next (ie. working with potential investees to manage risks in advance of investment, include an Environmental and Social Action plan (ESAP) as part of contractual agreement)

- Monitor and report on risks post investment including developing response processes, both for internal systems and public responses in the event of non-compliance