Ecotierra places communities at the heart of its approach to landscape restoration. Founded in 2011, Ecotierra works directly with small-scale producers to support sustainable land use practices that drive local economic development, combat climate change and reverse land degradation. However, in order to expand this approach, firms such as Ecotierra need more financial de-risking tools to reach the scale required to close the US $4.1 trillion nature financing gap.

In 2021, the Restoration Seed Capital Facility (RSCF) approved Ecotierra as one of its first two partners, providing support in the form of grant finance for pipeline and project development. To date, the grant funds have been used by Ecotierra to support its Urapi Sustainable Land Use fund for early-stage pipeline development in countries where Urapi has not previously invested. Support has also gone towards project development of a coffee and cocoa agroforestry project in Peru, which has the potential to rehabilitate or restore 6,500 Ha and generate up to 150,000 tons of CO2 equivalent in avoided and sequestered emissions.

The Urapi Fund invests directly in community-based sustainable agroforestry projects in Latin America, providing technical assistance and microfinancing through long-term debt and equity instruments to deliver market returns along with significant environmental and social impacts. Achieving a total close of USD 51 million in 2021, the Urapi Fund aims to triple the household incomes of its partner cooperative producers. The fund anticipates that 200 jobs will be created and 400,000 hectares will be reforested or conserved through Urapi’s investments. Overall, the impact of the funded projects will lead to over 7 million tons in captured and reduced CO2 emissions.

Community-First Model

Relationships are central to the business model of each of Ecotierra’s projects. Working with an in-country team, Ecotierra develops deep partnerships with local community groups and cooperatives. This community-first model focusses on empowering producers and strengthening their economic resilience by increasing product transparency and traceability, creating local jobs and working to increase household incomes while contributing to global climate and biodiversity goals.

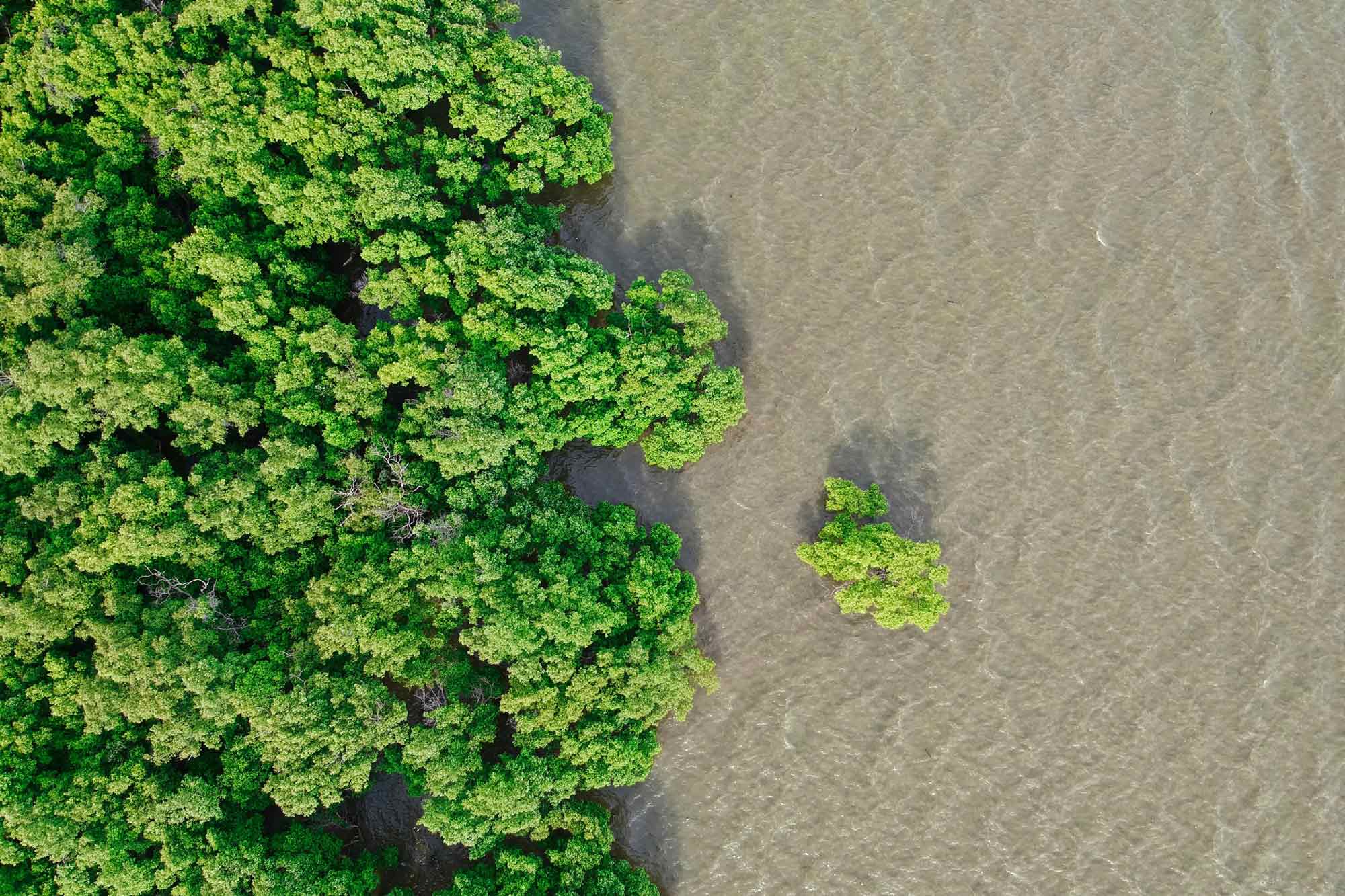

For over 20 years, Ecotierra has been active in the South American coffee and cocoa markets, allowing them to form deep connections with co-ops and facilitate project identification and development opportunities. “Co-ops see us as a strategic sales partner. We engage with co-ops on the sale side, as we sell 6,000 tons of coffee and cocoa per year and through this entry point, we talk with them about sustainable land use or gender or governance,” says Étienne Desmarais, CEO of Ecotierra. Developing intimate knowledge of the market allows Ecotierra to recognize gaps in the value chain and identify where they can create the most impact, whether that be through increasing yields of climate resilient crops, ensuring more land is dedicated to restoration activities, expanding forest coverage or supporting the diverse ecosystems of Central and South America.

“The pipeline is there but the gap needs to be bridged between investment ready projects and the resources required for the investment process itself,” says Desmarais, “the challenge is to develop a project within a reasonable timeframe that’s attractive to the co-ops, usually a 2-year project design process is too long.”

Ecotierra’s investment model is shaped by having an on the ground presence. This in-country partnership approach removes the dependence on external consultants to undertake arm’s length due diligence assessments and instead invests in teams in Colombia, Peru and Central America. For Desmarais, it is faster and more cost-efficient to support in-house teams who can create real value by developing local relationships and building institutional knowledge throughout the project development phase. “It takes time to form the team, but it’s a long-term strategy that pays off,” says Desmarais.

This holistic approach equally supports interdisciplinary collaboration between the internal sales, governance and carbon teams. “Each of our internal teams are working with different stakeholder groups who often don’t share the same goals. Small-scale farmers and big investors often don’t understand each other. The in-house team acts as a translator between those worlds.”

Beyond project identification, partnerships with local co-operatives are central to Ecotierra’s business plan. “We don’t want to operate all the components of the project ourselves. We create joint ventures between the fund and the co-op so that these businesses develop their own capacity, we just provide the tools,” Desmarais explains. This is also key to scaling up, with Ecotierra being able to use the resources of existing projects to support future project development.

How Public Finance Can Scale Up Private Investment

RSCF enables Ecotierra to better support co-ops through the project design phase, however according to Desmarais, guarantees are the key to incentivizing increased private investment and scaling up sustainable agroforestry projects.

According to Desmarais, “grants to develop project pipelines are great, but what we really need are de-risking tools and there’s not enough available. For us to really scale, our investors need more de-risking tools.”

“We know there are funds that buy land as the easiest strategy to scale up activities. But that’s not our approach. We want to work with local farmers, we want to preserve small-scale agriculture because it provides some livelihood to thousands of families, but it’s not easy. It’s risky.”

For Desmarais, the lack of de-risking tools presents a real challenge to engaging with the full cross-section of co-ops. “For us, it’s not about pilots or proof of concept projects anymore, we proved the business case ten years ago. Now there are a lot of people who know how to develop good projects and the problem is, when our investors evaluate the risk, they expect gross returns of 12-14% and that’s too much for small communities to deliver and still support decent livelihoods. We cannot work with a lot of potential projects because the return expectations of our investors are too high.” Guarantees or other de-risking mechanisms would “increase investor comfort and, in turn, reduce their rate of return expectations so we can scale up and work with more projects.”

Yet, the time and costs associated with seeking public finance support can present further roadblocks for groups such as Ecotierra to scale. Often development finance institutions charge the same rates for finance as the private sector and require their investment to be repaid first. This, on top of the additional requirements for data and reporting leads to the question, what additional value is public finance providing and how can this be improved?

For Desmarais, “the most helpful guarantee is a second loss mechanism, where public finance absorbs 20% of losses after the first 10% is absorbed by the fund or similar.”

Convergence’s State of Blended Finance 2021 report identified the challenges in deploying public finance, noting that the flow of blended finance had dropped by 50% in 2020 compared to 2019. While 2020 was impacted by COVID-19, the finding suggests that ongoing issues such as long timeframes and high transaction costs continue to be major roadblocks for public finance to provide the catalytic solutions the sector requires to scale. As the climate and biodiversity crises worsens, the time for government donors or multilateral fund to take two years to make a funding decision is increasingly at odds with the demand for support and the limited window that remains to ensure global warming remains within two degrees.

The Emergence of New Carbon Credit Income Streams

Ecotierra is actively engaged in the voluntary carbon market, however for the first fund, carbon credits were not considered a product but as a risk management tool instead. For Desmarais, carbon credits support project Key Performance Indicators (KPIs) as they can be a tool to measure and communicate impacts on the ground. Carbon credits generate a new income flow, however, according to Desmarais, the income isn’t enough to generate a significant return. “For the first fund it was less than 1% of the value over the entire fund. For the second fund, we’re talking about seeing carbon credits as a product, but it’s hard for investors to strongly believe in the current carbon credits market due to regulatory uncertainty. The money is there, the potential for the market is there, we’re just waiting for governments to provide the enabling environment.”

What’s next for Ecotierra

Ecotierra’s relationship-based approach was inevitably disrupted by COVID however, Ecotierra’s pipeline is growing and they are considering the development of a second fund within the next five years.