Arbaro Advisors has successfully closed three RSCF-supported investments for the Arbaro Fund in Peru, Ecuador and Guatemala, resulting in the first reflows to the facility.

The Arbaro Fund is an impact investment fund dedicated to sustainable forestry in Latin America, the Caribbean, and Sub-Saharan Africa, following strict E&S safeguards, including FSC certification requirements and IFC performance standards. The objective of the fund is to maximize environmental impacts and support social development, in particular the creation of fair, formal employment in rural areas.

The Arbaro Fund’s model involves acquiring and establishing greenfield and brownfield timber assets, operating these under FSC guidelines to strengthen sustainable forest management practices, supporting onsite production and developing timber value chains within the country.

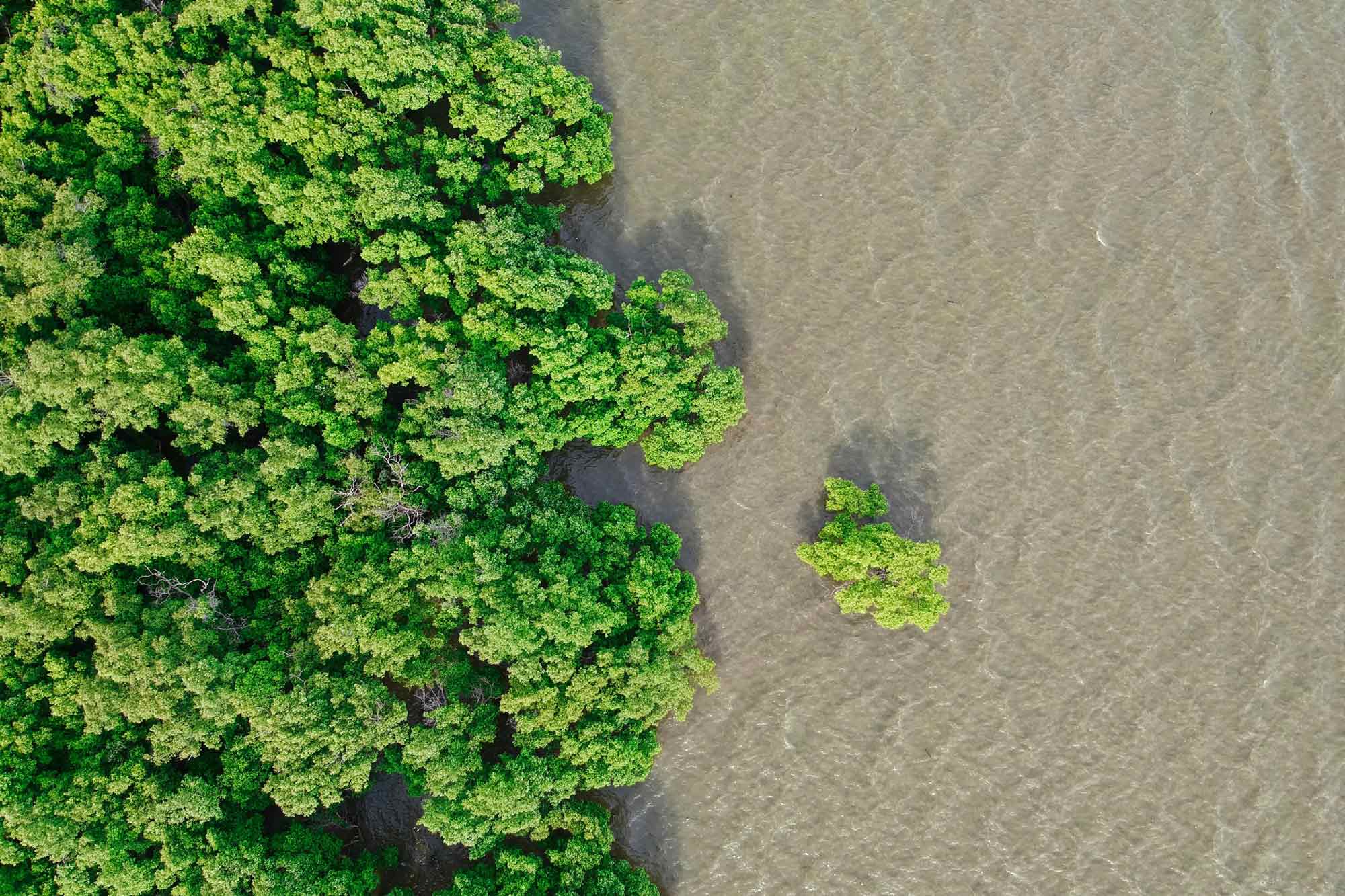

In each investment, the Arbaro Fund provides technical assistance to develop sustainable forest management capacity within local communities and earmarks natural forest and habitat areas for permanent protection and conservation, which in some cases is managed through a partnership with a local NGO.

RSCF pipeline and project development support enabled Arbaro to navigate the high degree of complexity and risk involved in its sustainable land use investment strategy.

In the case of the Arbaro Fund’s successfully closed RSCF-supported investments for example, there were no ready-made due diligence packs or independent consultancy reports for investors to consider, with the existing project management groups lacking the financial or other resource capacity to prepare standard investment materials.

Preparing comprehensive due diligence materials is resource intensive, encompassing significant human resources, knowledge, time and money. For long term, forest and land-based investments, there are several time- and cost-intensive issues to consider including land tenure assessments, developing local stakeholder relationships and establishing proper E&S base line and impact assessment measures.

The RSCF support allowed Arbaro Advisors to comprehensively compile due diligence materials simultaneously across several investments rather than sequentially and enabled Arbaro to effectively close the investments during its intended investment period, while also providing risk cover against broken deal costs.

RSCF provided project development support in the form of reimbursable grants to enable Arbaro Advisors to achieve strengthened E&S outcomes for each investment:

Maderas Prosperidad, Peru

In Peru, an investment in a family-owned forestry company, Maderas Prosperidad, will ensure the integration of sustainable forest management practices across the company, including replanting harvested plantation areas, the reforestation of unforested areas and the conservation of 400-600 ha of natural forests and vulnerable ecosystems, which make up 15-30% of the total project area.

The Maderas Prosperidad investment aims to sequester up to 0.6 million tons of carbon, provide formal employment and training opportunities for up to 180 direct and 450 indirect full-time employees (FTE) from local communities, some of whom are dependent on informal employment or subsistence agriculture, and establish a benefit-sharing model with the local community in the form of an off-take arrangement for the harvested wood.

The 3,750 ha greenfield and brownfield plantation lease, incorporating a value-chain investment into sawmilling, box-making and pallet production has a horizon of ~7-11 years.

The RSCF-supported investment will enable improvements to forest management practices across the project including seeking FSC certification; establishment of greenfield operations and protection of valuable habitat; the introduction of E&S standards both for plantation operations and processing facilities; and the implementation of a benefit sharing model with local communities to support livelihoods.

The project required several development stages from drafting a full business plan, sourcing strategies for the land and forest acquisition, and the assessment of land productivity and E&S impact potential. RSCF support was essential to undertake these assessments in a timely manner.

Ecua America Teak, Ecuador

In Ecuador, an investment in local forestry company, Ecua America Teak, will lead to the implementation of a robust E&S framework to ensure unforested and previously harvested areas are reforested and up to 20% of the project area will be set aside to conserve natural forest and vulnerable ecosystems.

The asset includes 1,400 ha of greenfield and brownfield production area and incorporates an existing sawmilling and pallets business.

The project will sequester up to 0.2 million tons of carbon, provide formal employment and training opportunities for up to 62 direct and 93 indirect FTE from local communities and provide local communities with an off-take arrangement for wood production.

The support from RSCF will enable the implementation of best practice E&S standards, including biodiversity monitoring, which would otherwise not take place in brownfield areas and the planting of nitrogen fixing plants, which will significantly improve wildlife habitat quality. With the E&S structures in place, the project is now moving to FSC certification.

Forestal del Caribe, Guatemala

In Guatemala, Arbaro has established the Forestal del Caribe company to supply FSC-certified timber to the local market. On the acquired land in the Izabal region, ca 1,000 ha of pasturelands and former rubber and eucalyptus plantations will be reforested and ca 600 ha or >35% of the total area of natural forests and vulnerable ecosystems will be set aside and conserved. In addition, an area of 600 ha of protected natural forest will be put under permanent protection in cooperation with FundaEco, a local NGO.

The project will apply a best-practice silvicultural approach. It further aims to sequester up to 100,000 tons of carbon and provide formal employment and training opportunities for up to 40 direct and 60 indirect FTE from local communities. The 1,700 ha greenfield project, which incorporates an offsite sawmill and pallet production, has a horizon of ~10 years.

The RSCF support will enable Arbaro to develop and finance a greenfield forestry project in a country, which is characterized by an underdeveloped timber market with low investment levels and lack of finance for forestry projects. The project will achieve strong additionality and have significant impact through the establishment of best forest management practices, educating the workforce and generating formal employment opportunities following a gender-sensitive approach. The project will also introduce FSC certification and develop a processing industry for plantation timber.

—

Through its support, RSCF enabled Arbaro Advisors to accelerate and expand its efforts in turning these opportunities into investments and contributed to achieving significant E&S outcomes beyond business-as-usual practices.